Aging, almost as everybody really wants to move quickly in the life span, no one would like to age rapidly. Everyone is attempting to create the most of the current moment, though they’re scared of what is ahead for them down the road. Age health, life, diet, and naturopathy health alternatives and protection, virtually everything about age scares us. We think that, because we move ahead, we are going to lose part of ourselves. We’re afraid that we won’t have the ability to care for ourselves & others better. Typically speaking, females live longer compared to males, therefore they symbolize a greater proportion of aging adults.…

Aging, almost as everybody really wants to move quickly in the life span, no one would like to age rapidly. Everyone is attempting to create the most of the current moment, though they’re scared of what is ahead for them down the road. Age health, life, diet, and naturopathy health alternatives and protection, virtually everything about age scares us. We think that, because we move ahead, we are going to lose part of ourselves. We’re afraid that we won’t have the ability to care for ourselves & others better. Typically speaking, females live longer compared to males, therefore they symbolize a greater proportion of aging adults.…

Navigating the Festive Season in Calgary: Tackling Credit Card Debt Responsibly

The holiday season in Calgary is a time of festive lights, snowy landscapes, and warm gatherings. However, for many residents, the joy of the season is overshadowed by the stress of managing credit card debt. If you find yourself facing this challenge, fear not—there are practical steps you can take to deal with credit card debt over the holidays in Edmonton.…

The holiday season in Calgary is a time of festive lights, snowy landscapes, and warm gatherings. However, for many residents, the joy of the season is overshadowed by the stress of managing credit card debt. If you find yourself facing this challenge, fear not—there are practical steps you can take to deal with credit card debt over the holidays in Edmonton.…

Where To Get Title Pawn Loans Canada

Title pawn loans Vancouver, also known as title loans, are a type of secured loan where borrowers use their vehicle’s title as collateral to secure a loan. If you’re in Canada and looking for title pawn loans, it’s important to understand where to find reputable lenders and the process involved.

Title pawn loans Vancouver, also known as title loans, are a type of secured loan where borrowers use their vehicle’s title as collateral to secure a loan. If you’re in Canada and looking for title pawn loans, it’s important to understand where to find reputable lenders and the process involved.

1. Online Lenders: Online lenders have become a popular source for title pawn loans Toronto. These lenders offer the convenience of applying online and often provide a quick response. To apply for a title pawn loan online, you will typically need to provide information about your vehicle, such as its make, model, year, and condition.…

Fixing Your Personal Debt Before Its Too Late

Personal debt can sometimes spiral out of control, causing stress and worry. It is crucial for individuals, including high school students, to address their debt problems promptly and develop effective strategies to regain financial stability. By utilizing a proactive approach that combines Canadian debt consolidation programs, budgeting, reducing expenses, seeking professional help, and prioritizing debt repayment, Canadians can tackle their personal debt and pave the way towards a healthier financial future.…

Personal debt can sometimes spiral out of control, causing stress and worry. It is crucial for individuals, including high school students, to address their debt problems promptly and develop effective strategies to regain financial stability. By utilizing a proactive approach that combines Canadian debt consolidation programs, budgeting, reducing expenses, seeking professional help, and prioritizing debt repayment, Canadians can tackle their personal debt and pave the way towards a healthier financial future.…

New Year 2022 Can Bring New Budget Choices

In the U.S., there are actually a number of big debt consolidations businesses in business now. Several of these businesses service consumers nationwide (and also can even do business offshore through subsidiaries), several companies have a far more narrower focus and only work within the own local communities of theirs.

In the U.S., there are actually a number of big debt consolidations businesses in business now. Several of these businesses service consumers nationwide (and also can even do business offshore through subsidiaries), several companies have a far more narrower focus and only work within the own local communities of theirs.

Among the better companies out there’s https://www.budgetplanners.net/. They work with non-profit counseling offices all across the USA. And according to the Better Business Bureau, of 3 companies, one has gotten some kind of complaint. Most consider Debt consolidation being an excellent, reputable debt-counseling corporation. There have never ever been some judgments positioned against them and they’ve never ever been in court.…

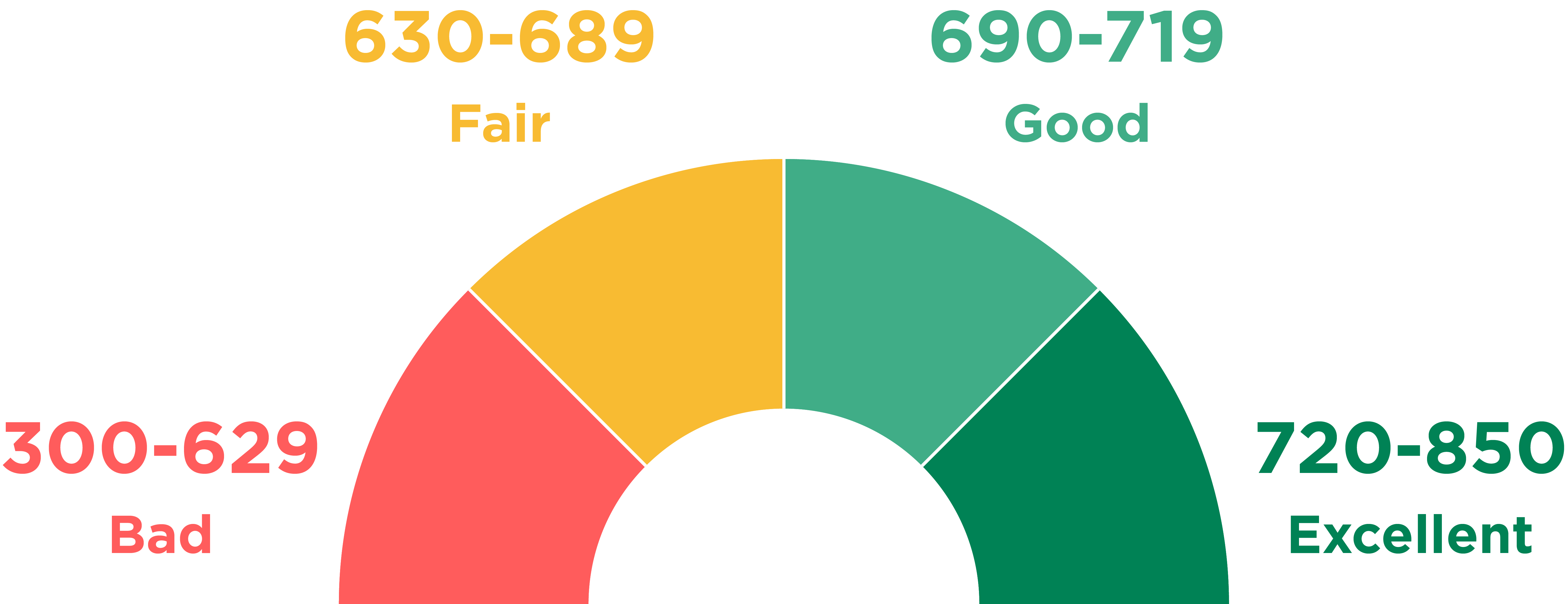

Positive Payment History Results In Higher Credit Score

Step one: Pay the bills of yours on time

Step one: Pay the bills of yours on time

The payment history accounts of yours for about thirty five % of your credit score much more than every other component. If perhaps you’ve a reputation of having to pay bills late, you have to begin paying them on time. If you have missed payments, get present and stay current. Each on-time payment updates good information to the credit report of yours. The greater the history of yours of having to pay bills on time, the taller that part of the credit score of yours is going to be.…

Chiropractic For All Natural Healing

Chiropractic is an all natural healing science, philosophy and art form mainly concerned with detecting then eliminating interference to the central nervous system of yours. Since your central nervous system controls every aspect of the body of yours, chiropractic could have a significant effect on several areas of the health of yours. Founded in 1895, it’s the world’s biggest drug free healthcare program as well as the 3rd largest main healthcare system in the USA powering dentistry and medicine. Over twenty five million Americans are going to see the chiropractor of theirs this year.…

Chiropractic is an all natural healing science, philosophy and art form mainly concerned with detecting then eliminating interference to the central nervous system of yours. Since your central nervous system controls every aspect of the body of yours, chiropractic could have a significant effect on several areas of the health of yours. Founded in 1895, it’s the world’s biggest drug free healthcare program as well as the 3rd largest main healthcare system in the USA powering dentistry and medicine. Over twenty five million Americans are going to see the chiropractor of theirs this year.…

Ideas To Help You Remove Your Debt

You can look to consolidate debt on as much as 4 credit cards or more, though it’s frustrating whenever you have debts, which grows into an issue for payback. Lots of charge card customers are powerless to pay off their big charge card debts which have added up as a result of the uncontrollable expenditure of theirs and additional interest rate that the banks continue adding each month to the primary amount. Below are a few ideas to consolidate debt and about how you can reduce the credit card debts of yours. Try them out!…

You can look to consolidate debt on as much as 4 credit cards or more, though it’s frustrating whenever you have debts, which grows into an issue for payback. Lots of charge card customers are powerless to pay off their big charge card debts which have added up as a result of the uncontrollable expenditure of theirs and additional interest rate that the banks continue adding each month to the primary amount. Below are a few ideas to consolidate debt and about how you can reduce the credit card debts of yours. Try them out!…

A Trip To The Mountains

Searching for a family summer time holiday? Would like a holiday that keeps all of the family entertained? Have to have a summer vacation destination which involves sunshine, food that is good, a lot as well as wine of fun family activities? Then why don’t you take a family summer vacation in the Alps!

Searching for a family summer time holiday? Would like a holiday that keeps all of the family entertained? Have to have a summer vacation destination which involves sunshine, food that is good, a lot as well as wine of fun family activities? Then why don’t you take a family summer vacation in the Alps!

Compared with a seaside holiday just where you’re continually tasked with ensuring the children are captivated which you will find activities all members of the household is able to enjoy together along with attempting to obtain some leisure time in for all the adults, a summer vacation to the Alps offers this but the added cost may require a loan…

Keeping Your Home Fresh And Up To Date This Spring

Home remodeling is a fairly standard event that the house owners undertake. This’s true for I realize that many people wanted the homes of ours to look happy and nicer to live. Therefore for all those that are imagining for home remodeling, here a few ideas from Design + Main to assist you in any home remodeling of project of yours.

Home remodeling is a fairly standard event that the house owners undertake. This’s true for I realize that many people wanted the homes of ours to look happy and nicer to live. Therefore for all those that are imagining for home remodeling, here a few ideas from Design + Main to assist you in any home remodeling of project of yours.

In the beginning most individuals believe on what way will their house look nicer and what is the potential design which will fit for the organic aura of the school. The idea of design for home remodeling in this feeling is packaged in. And so for the style for home remodeling you must determine whether you would like to employ an architect, an interior designer, along with additional household remodeling masters to make your house remodeling suggestions.…

Making Excuses For Exercise & Healthy Eating

In case making excuses was an Olympic event, might you be a gold medalist? For a lot of individuals attempting to slim down, making excuses not to work out or even modify the diet regime of theirs is frequently their greatest barrier to weight loss results.

In case making excuses was an Olympic event, might you be a gold medalist? For a lot of individuals attempting to slim down, making excuses not to work out or even modify the diet regime of theirs is frequently their greatest barrier to weight loss results.

In case making excuses is just one of the barriers of yours to effective long lasting weight reduction, following several of the tips and hints in this report is will aid you on the way of yours to getting the happier and healthier person you realize you are able to be.

Why individuals make excuses

Many of us make excuses from time to time. Probably the most typical reasons that we make excuses to avoid things, including physical exercise frequently to lose weight, include:…

Dont Let Your Adventures Put You In A Hole

When you track costs that you have to regularly pay, you will have affair idea of how much of the expenses on other things you can down in order to pay of the credit card debt. Some of the things you can’t through which are fixed such as mortgage, insurance etc. but you can cut down on your shopping expenses, phone bills, vacations and other extravagant spending sprees and you can actually save a lot. The expenses have to be kept track of, this way you now where you have gone overboard. Get help from the best in business with dealing with credit card debt in Canada.

When you track costs that you have to regularly pay, you will have affair idea of how much of the expenses on other things you can down in order to pay of the credit card debt. Some of the things you can’t through which are fixed such as mortgage, insurance etc. but you can cut down on your shopping expenses, phone bills, vacations and other extravagant spending sprees and you can actually save a lot. The expenses have to be kept track of, this way you now where you have gone overboard. Get help from the best in business with dealing with credit card debt in Canada.

How to get through the crises

The need to allocate budgets for all your expenses is essential and when your multiple credit cards you will have to track how much you are using them and what purposes. The credit may seem very enticing but having realistic perspective on the expenses that may collapse your future savings is what you should look out for. There is a need to build self-control and urge to go overboard on things that you resist purchasing or spending on. There isn’t a need to cut the basics but on the cutting down on extravagance, such as impulsive shopping on things you may not need or have very little use will be unnecessary expenditure that you can put off.

There are firms who give counselling on how to spend wisely and be thrifty in your expenses. It is not knowing how the income comes and goes and you can’t make head and tail of it when you incur a huge debt on your head. Being a budget and tracking person will not make you stingy or not enjoy life but be specific in what you have and what you want to do with it. A breathing space for the income can come is through save little by little and it comes handy in such situations. You may call it the emergency fund. By scheduling your expenses right to daily expenditure will allow you to cut back on so many unwarranted things you will be surprised at how much you can actually save.…